BrightQuery for Capital Markets

BrightQuery provides venture capital firms, private equity teams, hedge funds, investment banks, and M&A consultants with trusted, real-time data on private companies. Our platform combines financial transparency, ownership clarity, and operational insight—delivered through flexible tools and data feeds to support investment research, valuation, and strategic planning.

- Evaluate deal readiness with verified financial statements—including revenue, EBITDA, net income, and balance sheet details.

- Discover acquisition and investment targets using ownership hierarchies, UBO mapping, and growth metrics.

- Enhance valuation models and risk analysis with cross-industry benchmarks, financial ratios, and employment trends.

- Support due diligence and strategy with executive leadership data, legal status checks, and subsidiary structures.

GLOBAL COVERAGE:

U.S. COVERAGE:

The Foundation: What Makes BrightQuery’s Data Different

Organizations (Companies & Financials) 1, 2

- Extensive coverage of companies with detailed firmographics including EINs, DBAs, NAICS/SIC classifications, and legal entity transparency.

- Historic financial statements dating to 2017 include: revenue, gross margin, net income, EBITDA, debt, cash, and balance sheet metrics.

- Includes firmographics such as EIN, CIK, Ticker, NAICS/SIC codes, legal structure, and operational status.

✘ Competitors: Rely on survey-based or modeled data; limited financial history or legal structure insights.

Locations (Operational Footprint & Filtering) 3, 4

- Extensive coverage of business locations, including HQs, branches, remote sites, commercial and residential addresses.

- Enables location-specific due diligence, footprint validation, and competitive landscape mapping.

- Data includes industry tags, business type, geolocation, and registration source.

✘ Competitors: Primarily report only headquarters locations, missing real-world operational scale and local presence.

Legal Entities (KYB & Risk Compliance) 5, 6

- Legal entities mapped with corporate hierarchies and UBO relationships.

- Cross-jurisdictional visibility into subsidiaries, ultimate parents, foreign ownership, and regulatory status.

- Built-in monitoring for OFAC status, tax liens, and Secretary of State registration.

✘ Competitors: Offer only partial entity maps or focus on venture-backed firms, omitting many critical ownership linkages.

People (Decision-Makers & UBOs) 7, 8

- All contacts (business and legal entity level)—covering directors, officers, executives, and key decision-makers.

- Data includes job titles, phone/email, LinkedIn profile links, and legal roles for both UBOs and operating executives.

- Provides both legal entity view (control & compliance) and business entity view (strategy & operations).

✘ Competitors: Limited to publicly disclosed roles; rarely include private firm leadership, contact validation, or LinkedIn linking.

BrightQuery Products for KYB & Compliance

BQ Bulk Data Feeds – Support investment research and fund strategies with bulk ingestion of quarterly financials, UBO hierarchies, and executive data across public and private firms. 9

- A high-volume, structured delivery of BrightQuery’s full entity intelligence—including firmographics, financials, employment, locations, legal structures, and executive contact data—designed for integration into ERPs, CRMs, data lakes, or analytics platforms.

- Direct access to structured, government-sourced business data for automated risk assessments and compliance workflows.

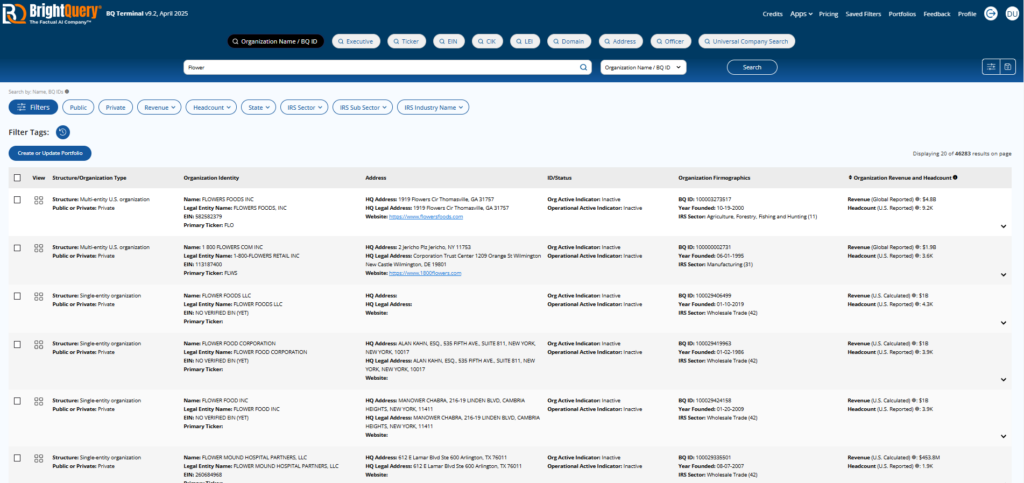

BQ Terminal – A due diligence interface for modeling investment targets and monitoring financial signals. 10

Product Type: UI tool

Delivery: Subscription

- A browser-based SaaS application that provides real-time access to public and private company profiles, including full firmographics, financials, legal entity details, and compliance indicators—designed for search, filtering, list-building, and report generation.

- Due diligence & deep research tool for private companies, with financial & legal insights.

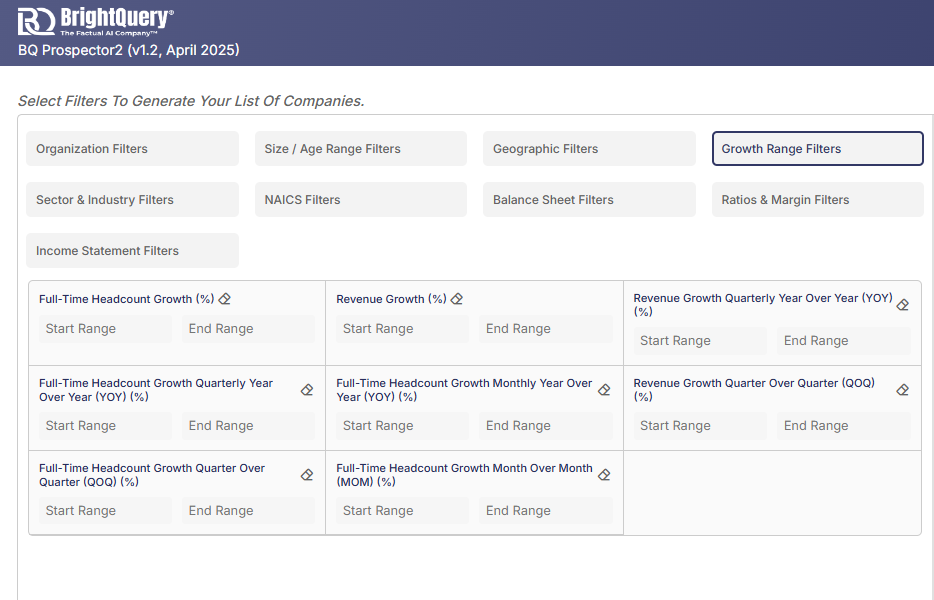

BQ Prospector – Filters the private company universe for strategic deal sourcing based on financial health. 11

- A lead generation and segmentation tool that enables users to filter U.S. businesses by growth, financials, industry, compliance, and contact info—returning pre-qualified B2B leads with emails, phones, and executive details.

- Advanced filtering for target companies, based on industry, revenue, credit, & employment data.

BQ Financials and Employment API – Deliver on-demand, TTM or historical company financials—like EBITDA, debt, gross margin, and payroll trends—for faster, automated due diligence, screening, and modeling. 12

- A real-time API that returns income statements, balance sheets, financial ratios, and monthly employment/payroll data for public and private U.S. companies, based on regulatory filings and labor records.

- Real time pulls of current and historic quarterly financials and monthly employment data.

- https://docs.brightquery.com/bq_company_firmographics.html

- https://docs.brightquery.com/org_with_financials_summary.html

- https://docs.brightquery.com/bq_organization_locations.html

- https://docs.brightquery.com/location_summary.html

- https://docs.brightquery.com/bq_legal_entity.html

- https://docs.brightquery.com/legal_entity_summary.html

- https://docs.brightquery.com/bq_organization_contacts.html

- https://docs.brightquery.com/contacts_summary.html

- https://docs.brightquery.com/bulk_data_feed.html

- https://docs.brightquery.com/terminal.html

- https://docs.brightquery.com/prospector.html

- https://docs.brightquery.com/financials_employment_api.html