BrightQuery for Business Credit & Risk Assessment

BrightQuery helps financial institutions, insurers, and alternative lenders unlock real-time, regulatory-grade insight into the businesses they serve. By combining verified financials, entity-level compliance, and decision-maker intelligence, BQ equips every team with the confidence to act—faster and smarter.

Banks & Credit Unions

- Evaluate borrower health using verified financials and entity-level compliance data.

- Detect fraud and shell structures through EIN validation, corporate hierarchies, and operational footprint analysis.

Insurance & Risk Underwriting

- Strengthen underwriting with benchmarked financials and verified business locations.

- Confirm legitimacy and exposure with full ownership mapping and industry comparisons.

FinTechs & Alternative Lenders

- Target growth-ready businesses with real financials, not proxies or estimates.

- Streamline KYB workflows using LinkedIn-matched officers and real-time compliance alerts.

GLOBAL COVERAGE:

U.S. COVERAGE:

The Foundation: What Makes BrightQuery’s Data Different

BrightQuery’s platform is structured around four foundational pillars that ensure business credit assessments are accurate, current, and fully compliant—delivering far more than just a credit score.

Organizations (Companies & Financials) 1, 2

- Income statements, balance sheets, gross margin, ROA, net income, cash, debt, payroll trends, growth rates, and historic financials

- EIN, CIK, Ticker, NAICS/SIC, legal structure, and operational status for every entity.

- Real financials from regulatory filings—not estimated or self-reported.

✘ Competitors: Rely on estimated or self-reported data, with limited or no access to verified financial statements or historical performance metrics.

Locations (Operational Footprint & Verification) 3, 4

- Includes HQs, branches, commercial/residential addresses, and international offices.

- Enables geolocation targeting and verifies borrower footprints to prevent location fraud.

✘ Competitors: Typically restrict location data to headquarters only, missing branch-level insight and offering little to no support for fraud detection through location verification.

Legal Entities (KYB & Risk Compliance) 5, 6

- Legal entities mapped, offering full ownership transparency to better understand complex organizational structures and relationships.

- Corporate hierarchy visibility with parent-subsidiary relationships, global UBO mapping, and business registrations.

- Customizable financial benchmarks and industry-wide comparisons enable precise risk assessment evaluating company performance against sector peers

- Detect financial and compliance risks using corporate structure analysis and real-time regulatory filings.

- Legal status, incorporation data, and regulatory standing. Built-in OFAC, bankruptcy, and tax lien screening.

✘ Competitors: Lack visibility into legal structures, UBO relationships, and compliance checks, limiting their effectiveness for due diligence and regulatory needs.

People (Decision-Makers & UBOs) 7, 8

- All contacts (business and legal entity level) are verified individuals, including directors, officers, and owners.

- Contact info includes email, phone, residential/commercial addresses, and job titles.

- Sourced from legal filings for compliance-grade accuracy, ensuring enhanced risk assessment for international creditworthiness. All matched to LinkedIn profiles for direct verification and outreach.

- Monthly employment data, allowing compliance teams to monitor workforce activity and operational health.

✘ Competitors: Depend on scraped or incomplete contact lists, often missing verified executive and ownership data needed for accurate risk profiling and outreach.

BrightQuery Products for Business Credit & Risk Assessment

BQ Bulk Data Feed – Enable large-scale credit modeling and portfolio scoring with feed-level access to private and public companies, including historical revenue, debt, and legal compliance attributes. 9

- A high-volume, structured delivery of BrightQuery’s full entity intelligence—including firmographics, financials, employment, locations, legal structures, and executive contact data—designed for integration into ERPs, CRMs, data lakes, or analytics platforms.

- Direct access to structured, government-sourced business data for automated risk assessments and compliance workflows.

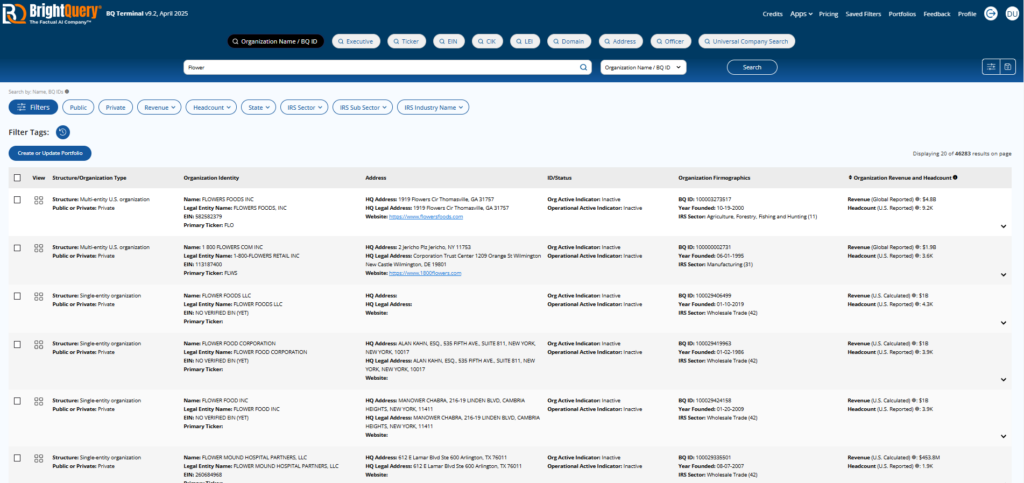

BQ Terminal – A central dashboard for financial stability checks and credit profile reviews. 10

Product Type: UI tool

Delivery: Subscription

- UA browser-based SaaS application that provides real-time access to public and private company profiles, including full firmographics, financials, legal entity details, and compliance indicators—designed for search, filtering, list-building, and report generation.

- Perform deep-dive due diligence with detailed firmographic, financial, and executive data.

- Ideal for loan officers, credit analysts, and risk managers.

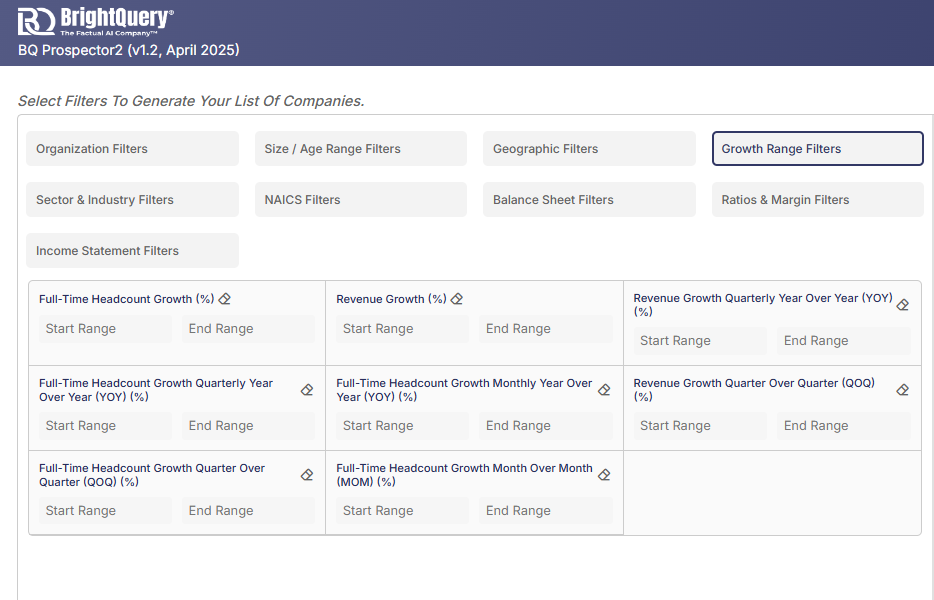

BQ Prospector – Used to source new lending candidates with verified credit and financial metrics. 11

Product Type: UI Tool

Delivery: Subscription

- A lead generation and segmentation tool that enables users to filter U.S. businesses by growth, financials, industry, compliance, and contact info—returning pre-qualified B2B leads with emails, phones, and executive details.

- Build target lists based on revenue, financial criteria, funding stage, growth rates, detailed industry categories, owner characteristics, job titles of contacts

- Helps credit unions, insurers, and alternative lenders find and evaluate high-quality leads.

- https://docs.brightquery.com/bq_company_firmographics.html

- https://docs.brightquery.com/org_with_financials_summary.html

- https://docs.brightquery.com/bq_organization_locations.html

- https://docs.brightquery.com/location_summary.html

- https://docs.brightquery.com/bq_legal_entity.html

- https://docs.brightquery.com/legal_entity_summary.html

- https://docs.brightquery.com/bq_organization_contacts.html

- https://docs.brightquery.com/contacts_summary.html

- https://docs.brightquery.com/bulk_data_feed.html

- https://docs.brightquery.com/terminal.html

- https://docs.brightquery.com/prospector.html